We believe everybody should be able to make online purchases with confidence. And while our website doesn’t feature every test prep company or review course in the universe, we’re proud that the advice we offer and the information we provide is accurate, truthful, objective - and entirely free.

So how do we actually make money? It’s simple, our partners compensate us. While this may influence which products we review and write about, and where they show up on the site, it absolutely does not influence our recommendations or guidance, which are formed by hundreds of hours of research and analysis. Check out our partners here.

What’s the bottom line? We’re on your team and are passionate about helping you achieve your career goals, even if it means we don’t make a dime.

Home CPA Exam Application Process

So, you’re ready to tackle the CPA exam? Great choice! Let’s talk about getting through that application process without pulling your hair out. It’s pretty much the same drill in every state, but there are always those tiny details that can trip you up.

Get it right, and you could be sitting for your first exam section in about a month or so. But miss a small step? Well, that’s when things can get a bit annoying.

I’m here to help you cut through the clutter that can come with passing the CPA exam! Think of this as your no-nonsense guide to breezing through the CPA exam application. I’ll cover everything from the nitty-gritty of fees and forms to what you need to send and where. And hey, I’ll even talk about those pesky little things like scheduling your exam and making sure your transcripts are in order.

The goal? To get you from ‘application’ to ‘approved’ without the headache. That way, you can focus on the real challenge – studying for and smashing that CPA exam. So, grab a coffee, and let’s get you on your way to becoming a CPA pro!

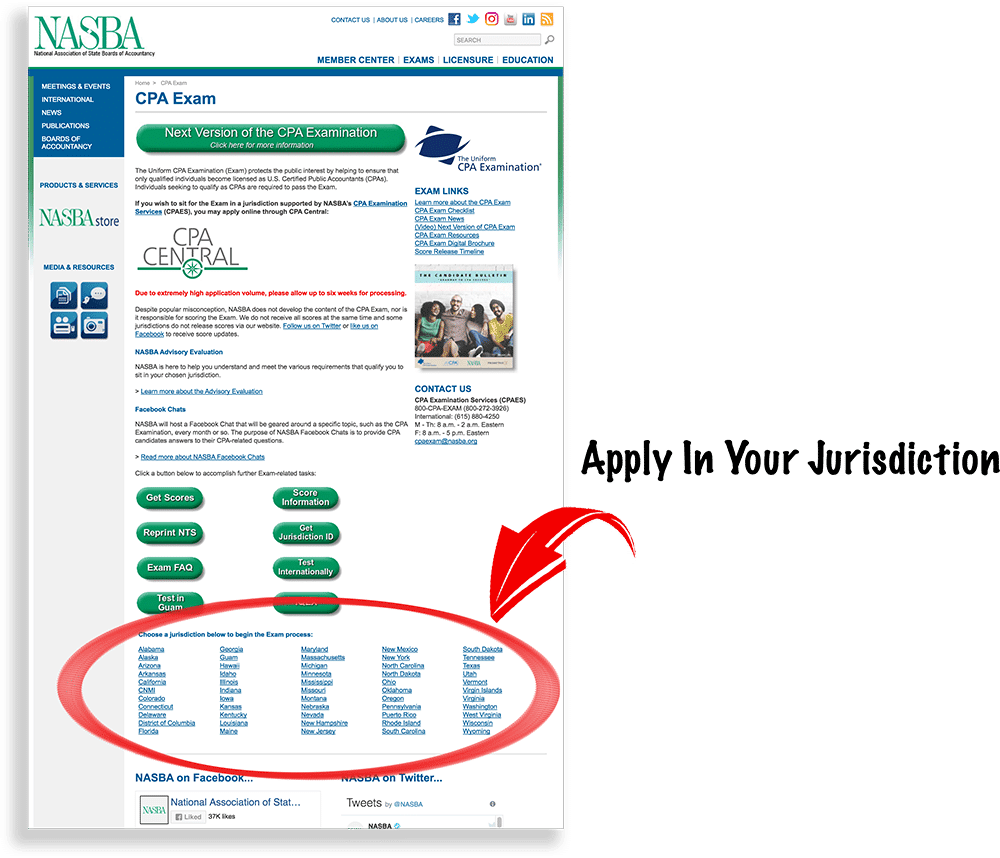

You must first qualify before you can apply for the Uniform CPA examination. This involves making sure that you have met all of your state requirements to sit for each CPA exam section. You can check your individual state requirements here.

You are officially eligible to start the application process once you have met all of the Uniform CPA exam qualifications. This can be a complicated ordeal if you accidentally skip a step or do it out of order, so my goal is to simplify this process for you.

The steps to submit CPA exam application forms and documents below are listed in chronological order and include links to necessary resources as well as valuable tips I learned from my own experience. This experience fuels my mission to help other CPA exam candidates get through the process as painfully as possible.

The steps to submit CPA exam application forms and documents below are listed in chronological order and include links to necessary resources as well as valuable tips I learned from my own experience. This experience fuels my mission to help other CPA exam candidates get through the process as painfully as possible.

Once you’ve completed the application and gathered all necessary documentation, submit these along with the application fee to your state board. This is typically $100-$200 per state. This can usually be done online, though some states may still require a paper submission.

Ensure you keep copies of all documents and confirmations of submission for your records.

One of the critical steps is understanding the Authorization to Test (ATT) and its validity period. This understanding is crucial as it directly impacts your exam scheduling and preparation strategy.

The ATT is an official document that signifies your eligibility to sit for the CPA exam. It is issued by your State Board of Accountancy after your application is approved.

A Notice to Schedule (NTS) is your official document that authorizes you to sit for the CPA exam in the United States. Couple notes about your NTS:

“Boards of Accountancy will set a time period for which an NTS is valid (generally six months) during which you must schedule and take the examination section(s), after which it will expire and all fees will be forfeited.” – NASBA

To learn about Testing Windows and find out what months you are not allowed to sit for the CPA exam click here.

CPA Exam Rescheduling Fees:

*I would suggest that you schedule your exams at least 3-4 weeks in advance

Applying for and taking the CPA exam involves various fees, which can vary depending on the state in which you are applying. It’s important to have a clear understanding of these fees as part of your exam preparation and budgeting.

You MUST bring your Notice to Schedule with you to the Prometric testing center or you will not be able to take your exam! (I made this mistake once but luckily was able to race home, grab it, and get back in time to take it.. my Toyota Corolla has never driven so fast!)

You are also required to present two forms of identification at the test center, one of which must contain a recent photograph. Each form of ID must bear your signature and cannot be expired.

You can waste weeks of valuable study time waiting for your Notice to Schedule. Use that time to get a head start on the section you want to tackle first and jump on it today. No excuses, no more procrastinating, just do it!

Be sure to check out my top 5 CPA courses on the market in this side-by-side CPA review course comparison to find out which one is the best fit for you.

Eligibility varies by state, but generally includes educational requirements (often 150 credit hours with a certain number of accounting and business courses), passing an ethics exam, and sometimes work experience. Check your state’s specific requirements for detailed information.

How do I apply for the CPA exam?The application process involves submitting an application to your State Board of Accountancy, paying an application fee, and providing necessary documentation like official school transcripts. The process may vary slightly by state.

How much does it cost to apply for the CPA exam?Application fees typically range from $100 to $200, varying by state. Additionally, there are separate fees for each exam section, generally ranging from $175 to $400 per section.

Are there state-specific variations in the CPA exam application process?Yes, each state may have different rules and timelines. For example, some states have a six-month Notice to Schedule (NTS) validation period, while others offer extended periods.

What is the Authorization to Test (ATT), and how long is it valid?The ATT is a document that signifies your eligibility to sit for the CPA exam, issued by your State Board of Accountancy. Its standard validity period is 90 days in most states, during which you must select your exam sections.

What is the Notice to Schedule (NTS)?The NTS is an official document from NASBA that authorizes you to schedule and sit for the CPA exam. You’ll receive it after your application is approved, usually within 3-6 weeks.

How do I apply for the NTS?To apply for the NTS, you first need to submit your CPA exam application to your State Board of Accountancy and pay the required fees. Once your application is approved, the NTS will be issued to you by NASBA.

How long does it take to get the NTS for the CPA exam?The time to receive your Notice to Schedule (NTS) can vary, but typically it takes between 3 to 6 weeks after your application is approved. Some states offer faster processing times, allowing you to receive the NTS more quickly.

How long does the NTS last?The validity period of the NTS varies by state. In most states, the NTS is valid for 90 days, while some states offer a six-month validity period. Certain states like California, Hawaii, and Utah have extended periods of up to 9 or 12 months.

How do I schedule the CPA exam with my NTS?Once you receive your NTS, you can schedule your CPA exam sections through the Prometric website. Enter your NTS number, section ID, and personal details to select your preferred date and testing location.

What is the section ID for the CPA exam?The section ID is a unique identifier for each of the four sections of the CPA exam (AUD, BEC, FAR, REG). It is provided in your NTS and is used when scheduling your exam sections at a Prometric testing center.

How long does the CPA application process take?The duration of the CPA application process can vary based on several factors, including the processing time of your State Board and the completeness of your application. Generally, it can take a few weeks to a couple of months.

What should I bring to the CPA exam?You must bring your Notice to Schedule and two forms of identification to the Prometric testing center. One ID must contain a recent photograph, and both should bear your signature and not be expired.

What happens if I pass one section of the CPA exam?Once you pass your first CPA exam section, you have 18 months to pass the remaining three sections.

Can I take the CPA exam in a different state from where I applied?Yes, you are not restricted to taking the exam in your state and can take it at any Prometric location.

Can I apply to multiple states or jurisdictions for the CPA exam?You may apply to any state or jurisdiction, but you can only register to take the exam in one jurisdiction at a time.

What are the rescheduling fees for the CPA exam?Rescheduling fees vary based on the notice period. Rescheduling more than 30 days in advance typically has no penalty, while rescheduling 1-5 days before the exam can incur a fee equivalent to the full price of the exam section.

Bryce Welker is a regular contributor to Forbes, Inc.com, YEC and Business Insider. After graduating from San Diego State University he went on to earn his Certified Public Accountant license and created CrushTheCPAexam.com to share his knowledge and experience to help other accountants become CPAs too. Bryce was named one of Accounting Today’s “Accountants To Watch” among other accolades. As Seen On Forbes